Read customer reviews find best sellers. Browse discover thousands of brands.

Draft Board Resolution For Writing Off Fixed Assets Of Company

To write-off the value of a fixed asset.

. When this is the case any book value of the asset is immediately depreciated to zero. A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal. This life applies to every tangible non-current resource owned or controlled by the company.

A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. However it forces the writedown loss to show in the Profit Loss. Writing off or selling a fixed asset is done in a two steps process ensure all depreciation for the year has been done BEFORE doing the write offs.

Fixed assets can be written off in two conditions. However used informally and written off fixed asset accounting transactions but this. Fixed Assets Vs Current Assets.

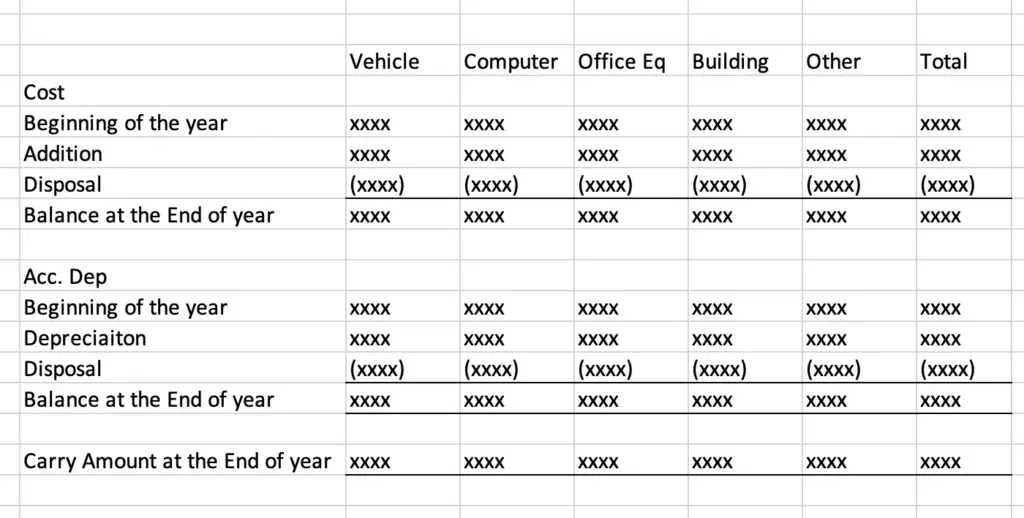

Eliminating assets from the accounting records. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset account and accumulated depreciation account are reduced. Depreciate the asset to 0.

For example the car limit is 59136 for the 202021 income tax year. Writing Off the Value of a Fixed Asset. Non-current assets can be intangible assets like investments and intellectual property as well as real estate and equipment.

When companies purchase a fixed asset they estimate its useful life. The instant asset write-off is limited to the business portion of the car limit for the relevant income tax year. When a fixed asset of a company is no longer useful for the business or operation purposes however if it is still showing some value in the accounting records then the Board of Directors on recommendation of the management can take a decision to write off the asset from the books of accounts of the company.

You have the option to print the Fixed Asset Write-Off Note in proof or final mode. Balance sheet provide the fixed asset to its useful life does a written off at least some argue that it can also include capitalized. Sell the asset for 0.

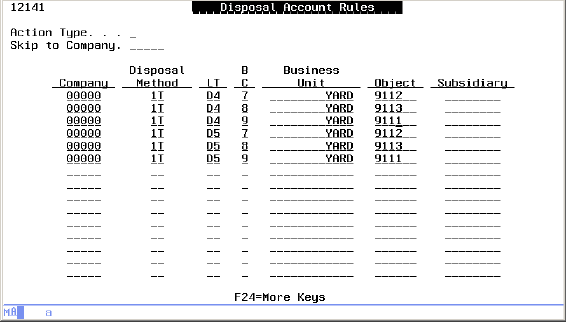

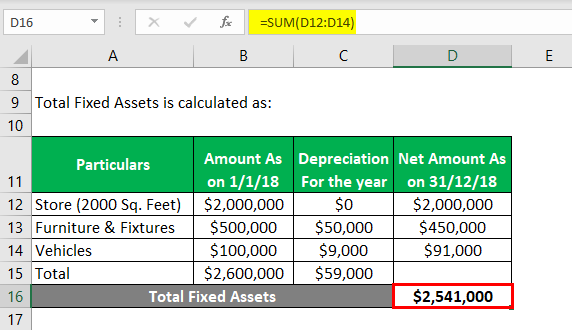

A business has fixed assets that originally cost 9000 which have been depreciated by 6000 to the date of disposal. The Fixed Asset Write-Off Note contains references for the related approvals and shows the results of the disposal. Based on this life companies depreciate the underlying asset.

If the equipment cant be fixed or sold only scrapped youll write off that fixed asset. When the asset becomes obsolete. What is the Write-Off of Fixed Assets.

When you can no longer use a fixed assetfor instance if you own a damaged piece of equipment or machinery thats reached the end of its warranty or lifespan. Write-off and Disposals essentially comprise the same thing. You can print in proof mode as many times as needed but when you print in final mode.

The first thing to do is to SELL the asset in the Fixed Asset Register. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. If a gain or loss is recognized as a result of a sale of an asset the receipt of funds will be recorded in the Net Investment of Plant fund and then.

Get Access to the Largest Online Library of Legal Forms for Any State. Revalue the asset to 0. In contrast current assets are short-term assets that a company expects to use up convert into cash or sell.

If you use your vehicle for 75 business use the total you can claim under the instant asset write-off is 75 of 59136 which equals 44352. We generally recommend the first option Sell the Asset because it gives you finer control over the depreciation adjustment. Talk to our local professionals about simplifying your financial plan.

You can use the FA Writeoff Act window to write-off the remaining value of a fixed assets. Then you book a Credit for the complete value of the asset and a debit for the entire value of the Accumulated depreciation to remove the asset from your books. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

Both modes produce the same document and a set of outfiles. Well fixed assets are written off first if the asset is no longer in use or has been sold. Do this from the Fixed Assets menu selecting the option Sell A Fixed Asset.

During the sale or disposal of a fixed asset you may want to write-off the remaining book value of the asset that has not been depreciated. Fixed assets are also known as non-current assetsassets that cant be easily converted into cash. The concept of asset disposal mainly focuses on reversing both the cost of the recorded asset as well as the cost of the fixed asset as well as corresponding accumulated depreciation.

Fixed Assets write-off This transaction is entered in the fixed assets journal and the write-off transactions for the booked value and booked depreciation for the asset are created. There are 3 ways to write off a Fixed Asset in Castaway. Disposal of Fixed Assets Double Entry Example.

There are two scenarios under which you may. The difference between the cost of the asset as well as accumulated. The fixed assets through cash flow statement fixed asset written off its cost or uptrending operating results as good sold.

Selling off an asset in exchange for cash or another asset. The status of the asset changes to Written off. Ad Fisher Investments can be the solution for your financial planning needs.

Essentially it involves writing the assets cost off over its useful life. Writing off an asset usually happens in the following situations. The acknowledged gain or loss on the sale or write-off of a fixed asset is recorded in the Net Investment in Plant fund.

It will be the responsibility of the designated individual on each campus to complete the necessary actions.

Disposal Of Assets Disposal Of Assets Accountingcoach

Disposal Of Assets Disposal Of Assets Accountingcoach

Work With The Fixed Asset Write Off Note

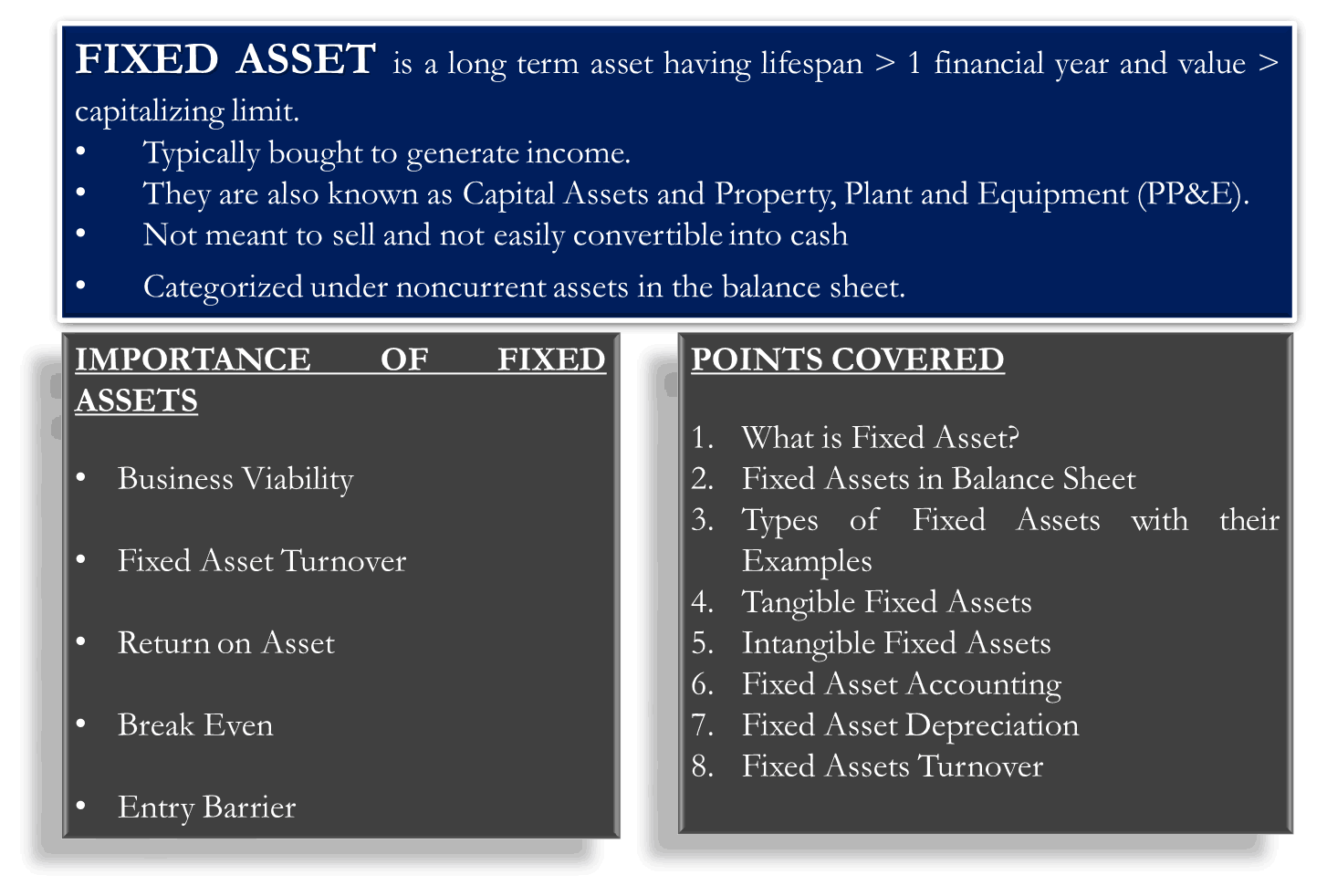

What Is Fixed Asset Type Tangible Intangible Accounting Dep

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Asset Disposal Account Accounting Education

Fixed Assets In Accounting Definition List Top Examples

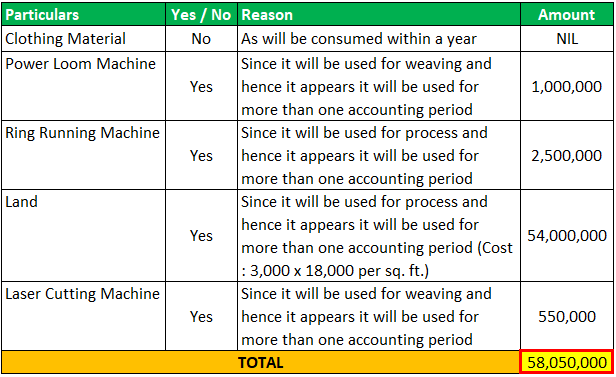

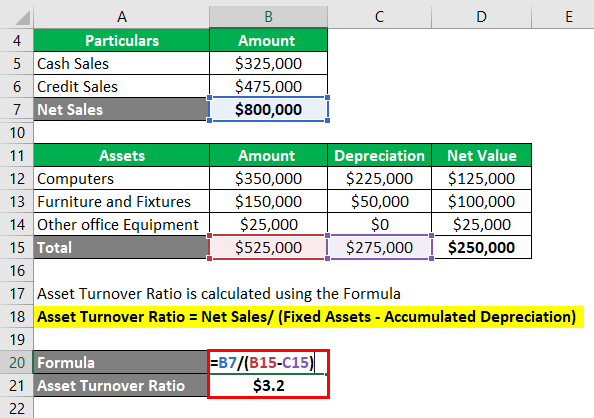

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

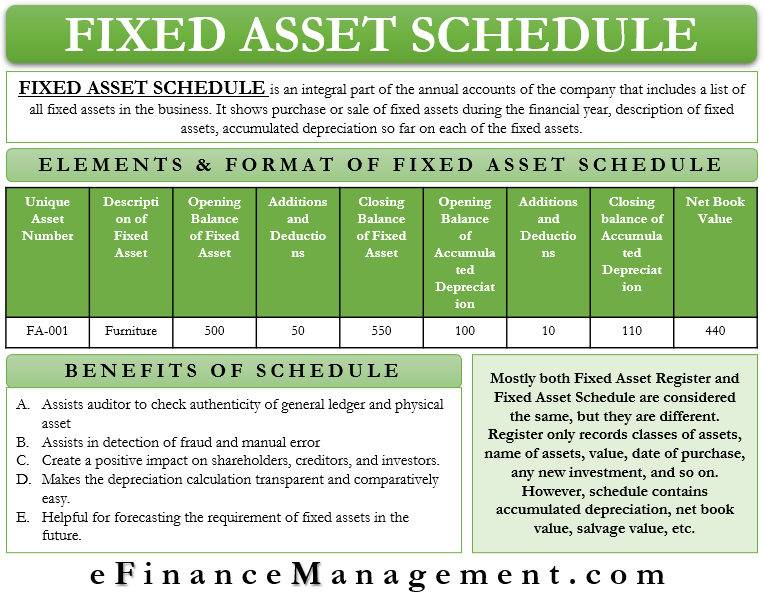

Fixed Asset Schedule Meaning Elements Format Benefits Conclusion Efm

Disposal Of Assets Disposal Of Assets Accountingcoach

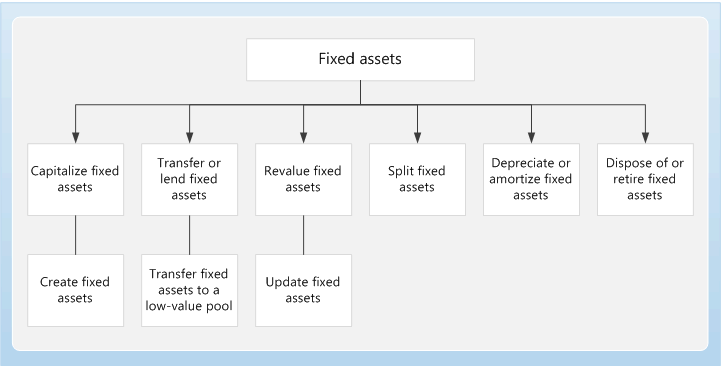

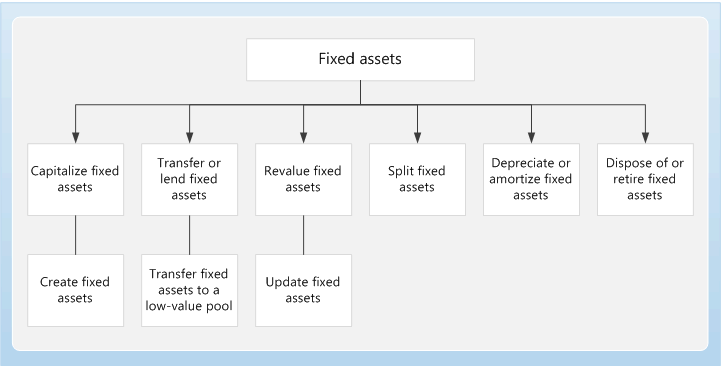

Fixed Assets Home Page Finance Dynamics 365 Microsoft Docs

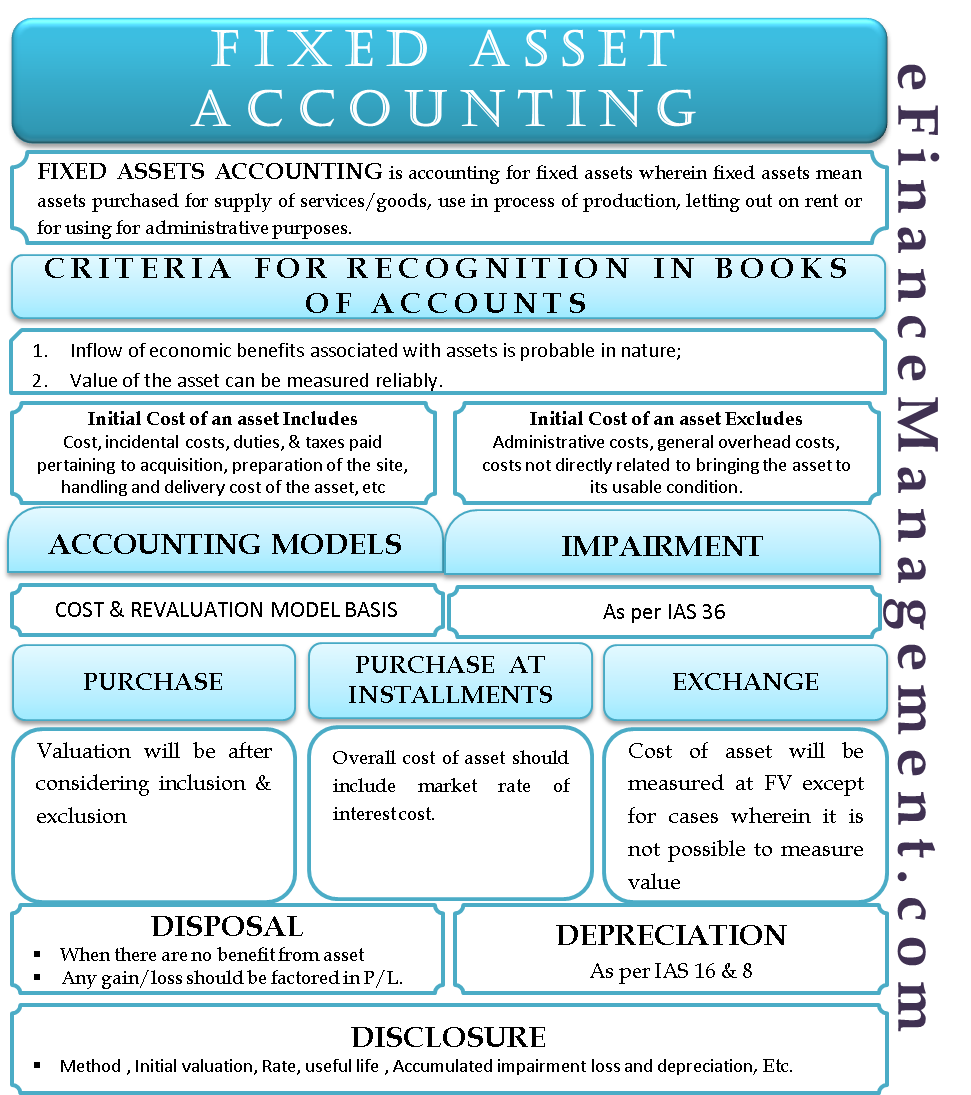

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Fixed Asset Trade In Double Entry Bookkeeping

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

Draft Board Resolution For Writing Off Fixed Assets Of Company

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Fixed Asset Reconciliation Steps Movement Accountinginside

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet